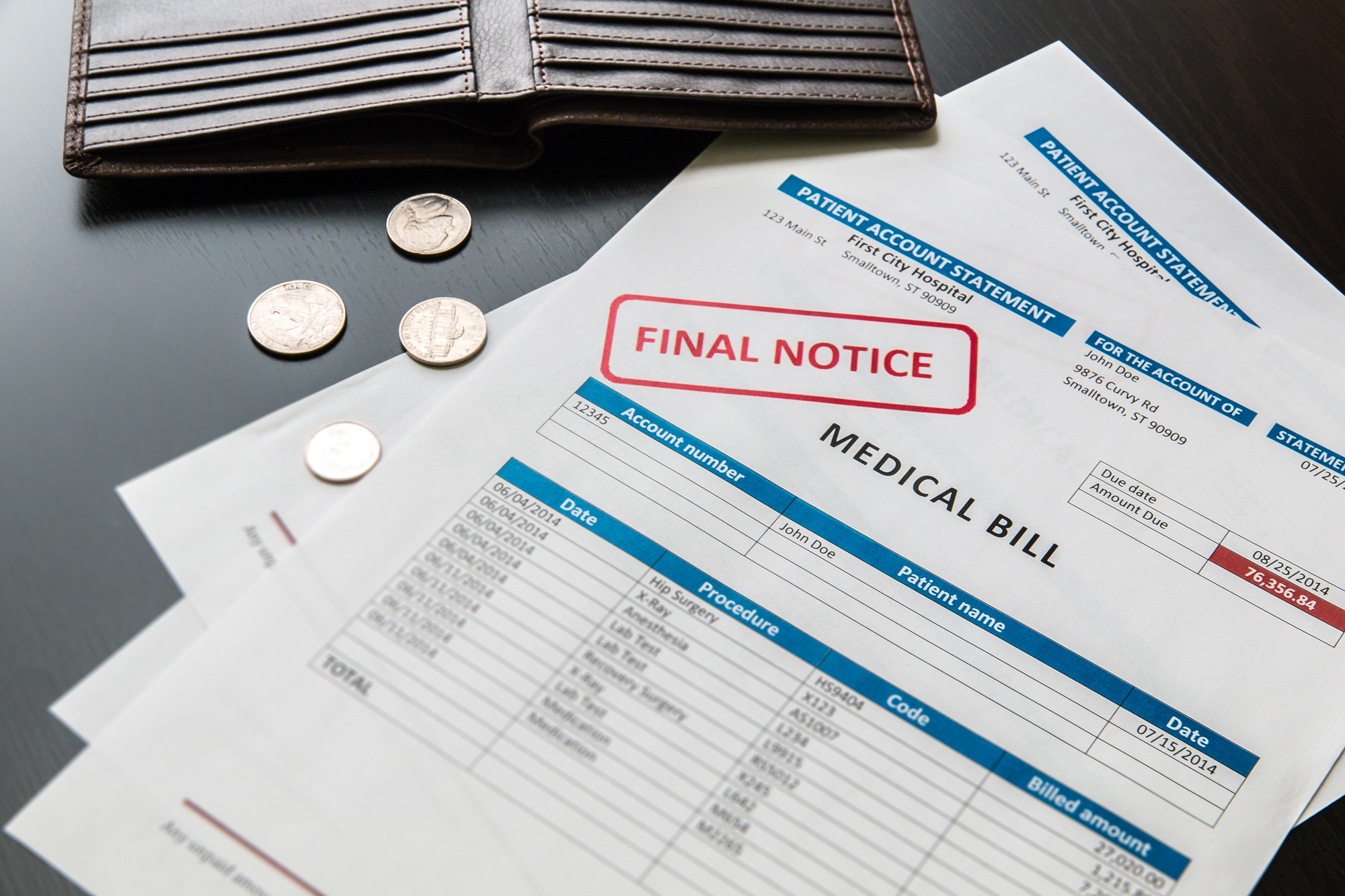

If you’ve ever had a medical procedure, whether it was an emergency or planned, you already know it’s expensive. The average American spends over $7,000 a year on medical services.

A lot of people struggle to pay these bills back, especially if an emergency surgery occurred, and you’re in far more debt than you can afford.

So what do you do now? How do you pay your debt? Keep reading to learn how to pay off medical bills.

What You Should Not Do

Let’s start with what not to do when it comes to your medical debt. First, don’t ignore these bills.

You’re required to pay back the debt, and ignoring the bills will only mean trouble for you down the line. You’ll not only be bombarded by debt collectors, but it will also take a big hit to your credit score.

Also, in order to not create more debt for yourself, you should avoid paying off medical bills with a credit card. There are millions of people in the US in credit card debt that they’re unable to pay back, so this is likely not the best solution.

This is because carrying a balance on your credit card that you can’t pay back can lead to high-interest rates that creates more debt.

There’s also more room to work with the billing department for medical bill payments and create a payment schedule that you’re more likely to be able to afford than paying off a credit card.

Make Sure the Bill is Correct and Try to Work With Billing Department

Once you’re ready to face these medical bills, make sure you first check that all the charges are accurate.

It’s possible you could see charges for services you didn’t receive, so it’s best to review your entire bill. Ensure that you took all the medications that you were charged for. Also, make sure they didn’t charge you for a full hospital stay for a day when you checked out in the morning.

Once you confirm the charges or have incorrect charges removed, you should try to negotiate the bill. Your healthcare provider will have a medical billing manager, who has the ability to lower the bill.

You don’t want to wait until the bill is sent to collections to handle it because it could have already affected your credit score by that point. You should talk to the billing manager as soon as you get the bill.

If you are someone with a low-income status or experiencing financial hardship, you can request hardship assistance. You may also be able to receive hospital charity care.

You could also compare the price you’ve been charged to an average price for the services you received, after doing some research. Try to work with them based on the amount you find.

Pay in a Lump Sum if You Can Afford It

While negotiating, one strategy you can use is trying to pay it all in a lump sum for a discount. Ask if you pay in full, can they take a certain percentage off the cost.

This strategy is effective if you aren’t low income, but can’t necessarily afford the full cost of the medical bill. But, if you can’t afford to pay anything at the moment, you’ll need to set up a payment plan.

Set Up a Payment Plan

Interest-free payment plans are possible if you work with the doctor’s office or hospital and discuss an amount you can afford to pay each month. Advocate for yourself and be realistic about the payment plan so you don’t get stuck in a different situation you can’t afford.

You can work with the billing department to set up the payment plan. This will also allow you to slowly pay off the debt without affecting your credit score.

Apply for Financial Assistance or a Loan

Another option is to use a loan to pay off your medical bills, but this should not be your first option. You could end up with a high-interest rate, so this may not be a better option than using your credit card.

But there are certain loan companies that have special loans for medical expenses. Be sure to do your research and compare the interest rates to others on the market.

Work with Collection Agencies

If you can’t pay a hospital bill and it does end up with a collection agency, you can still work with these departments to work with them and make a payment plan. You should also specifically ask them to hold off sending information to credit bureaus or other debt collectors.

Dealing with debt collectors calling you constantly can be overwhelming and can get heated. Be sure to record phone calls if you feel threatened, and remain calm so that you can come to an agreement about what you can pay.

Keep proof of payment, and if your credit score did take a hit, make sure you tell the debt collector to report the payment to the credit agencies. You can also do this yourself, and you should.

Consolidate Your Debt

If you have a lot of payments with different interest rates, including medical bills, credit cards, etc., a great solution is to consolidate the debt.

With debt consolidation, you can combine all of these high-interest payments into a single payment. You can also end up paying much lower interest rates. This solution might even be able to remove the interest rate.

Learn How to Pay Off Medical Bills with These Strategies

Learning how to pay off medical bills is important to ensure you don’t end up with a lot of debt and a bad credit score. Make sure you handle these bills as soon as you receive them and follow the strategies above to pay them off.

Contact us today to learn more about how we can help you consolidate your debt and lower your interest rates today!