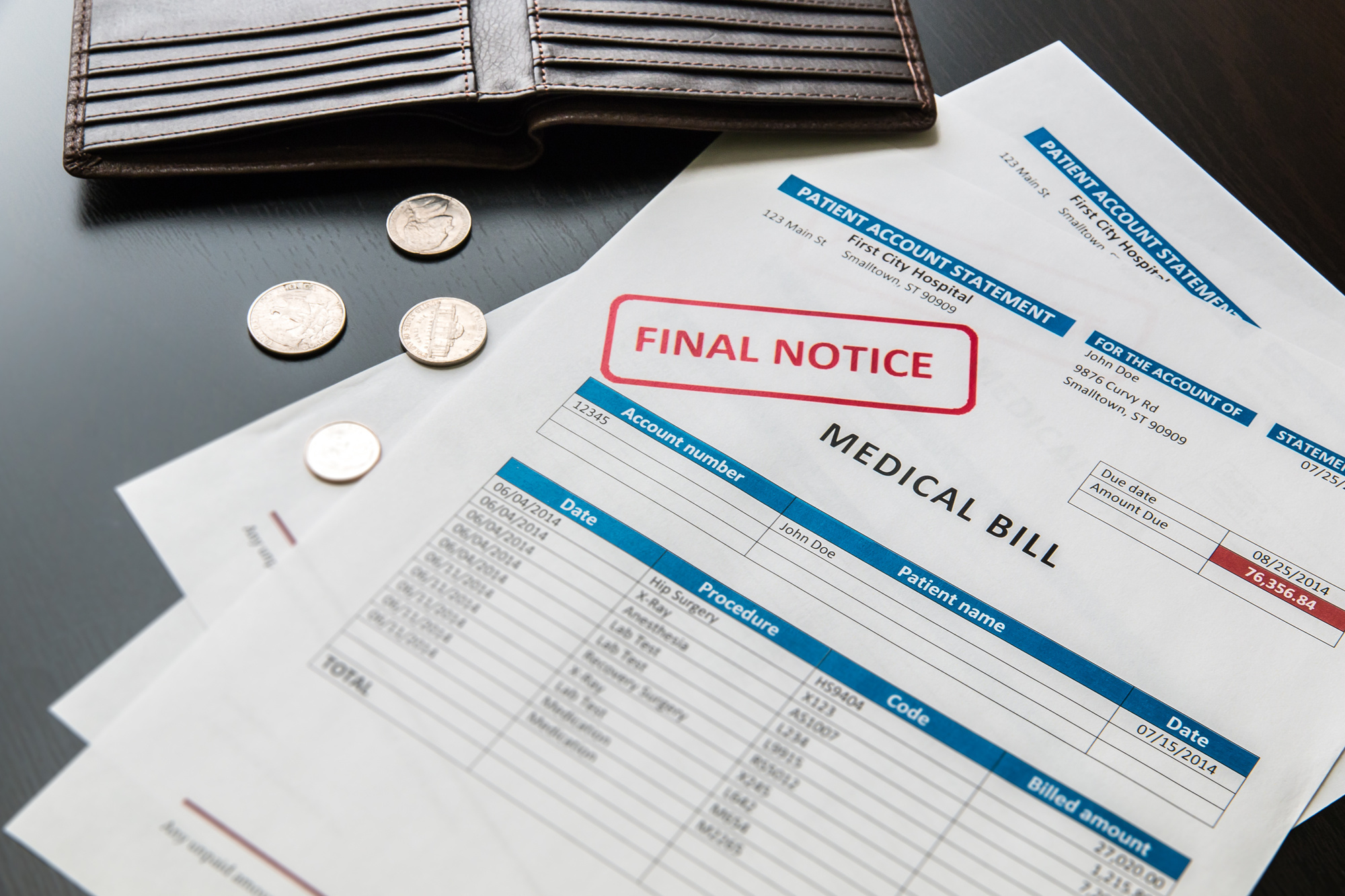

Do you need help paying hospital bills?

If so, you are not alone. Poll results from the Kaiser Family Foundation reveal that roughly a quarter of American families have had problems meeting medical bills.

This is not surprising, seeing as health care in the US is more expensive than in any other country in the world.

If you are facing unforeseen and hefty medical debt, there is no reason to feel ashamed of this. It can happen to anyone, at any time.

However, what you must do is figure out how to clear it. Otherwise, your credit score could be affected and you could even face lawsuit action.

Fortunately, there are many things you can do to reduce your medical debt. Read on to find out what these are.

What Happens When You Don’t Pay Your Medical Bills?

The first thing you need to know is what exactly happens when you don’t pay your medical bills.

Initially, the hospital or other health care provider will attempt to collect the debt from you. If you do not make payment, at some point, the debt is usually sold to a debt collections company.

Once there, the collections agency will begin to pursue you for the debt. This will usually take the form of phone calls, emails, or letters. If you do not make any arrangements to pay, after a certain time period the agency might file a civil lawsuit against you.

When your bill goes to collections, this automatically dings your credit score. A record of the unmet debt will remain on your credit report for up to 7 years. To prevent this, it is always a good idea to communicate with your health care provider and ask them to give you more time to pay off the debt, rather than handing it over to collections.

Start by Minimizing Your Hospital Debt

The very first thing you can do to resolve your hospital debt is to reduce it in any way that you can. Here are a couple of methods.

Check Your Medical Bills for Errors

It is well worth checking through your medical bill for errors. Research has shown that up to 90% of medical bills can contain errors. These include things like double charging.

If you can ferret out these errors, you could stand to substantially reduce your liability total.

Discuss With the Health Care Provider

The next step you can take is to discuss with the health care provider or hospital. Many hospitals will grant you longer terms (and thereby smaller monthly payments) if you ask. Don’t be shy! Go back and ask for a different option if the initial monthly amount they suggest is too high for you.

In addition to better terms, you can also inquire whether you might be able to secure a zero rate of interest. Some hospitals do provide this, but you have to ask.

Lastly, another point of restructuring is around insurance rates. Most hospitals give insurance providers reduced/discounted rates. As a layperson, it might be harder to get this discount, but it doesn’t hurt to ask.

All you need to do is approach the health care provider and state that you are paying the amount out of pocket, are in need of assistance, and would like to enquire if it is possible to secure the same discount that applies to Medicaid and other insurers.

Check to With the Hospital to See If You Are Eligible for Financial Assistance

Lastly, depending on your income bracket, you might be eligible for financial assistance from your hospital. Most hospitals will require you to apply for Medicaid first. If you do not qualify, they might have an additional assistance program.

Look Into Debt Resolution

If you have done all of the above, and are still wondering how you will be able to pay off the remaining hospital expenses—the next thing you can do is look into debt resolution.

Debt resolution can come in a couple of different forms. Let’s take a look.

Debt Consolidation

A common form of debt resolution is debt consolidation. If you have multiple medical debts from different sources, this option might benefit you.

Debt consolidation combines your debts in one place, allowing you to make one monthly payment. This is a lot simpler than keeping track of multiple different debt payments each month. It’s also easier to budget for.

What’s more, during debt consolidation, sometimes it is possible to secure a lower rate of interest than what you are currently paying on your debts.

In the case of hospital bills, this is trickier to manage than with other debts, as medical debts tend to have low rates of interest as it is.

However, in some cases, you might be able to secure a zero rate of interest through a transfer balance card. Besides consolidating your debts, some cards also offer the option of 0% interest for the first 12-24 months.

If you will be able to restructure your medical bills within this time (and you can’t get a zero rate of interest from your hospital), then this option could all save you from paying unnecessary interest. Be aware, however, that if you don’t pay off the balance before the zero interest period is over you will begin paying regular credit card rates.

Need Help Paying Hospital Bills? Leverage Our Matching Tool

If you need help paying hospital bills, you can start right here. Take advantage of our matching tool that pairs you up with the best options tailored to your needs.

If you have any questions, feel free to contact us. We look forward to hearing from you.