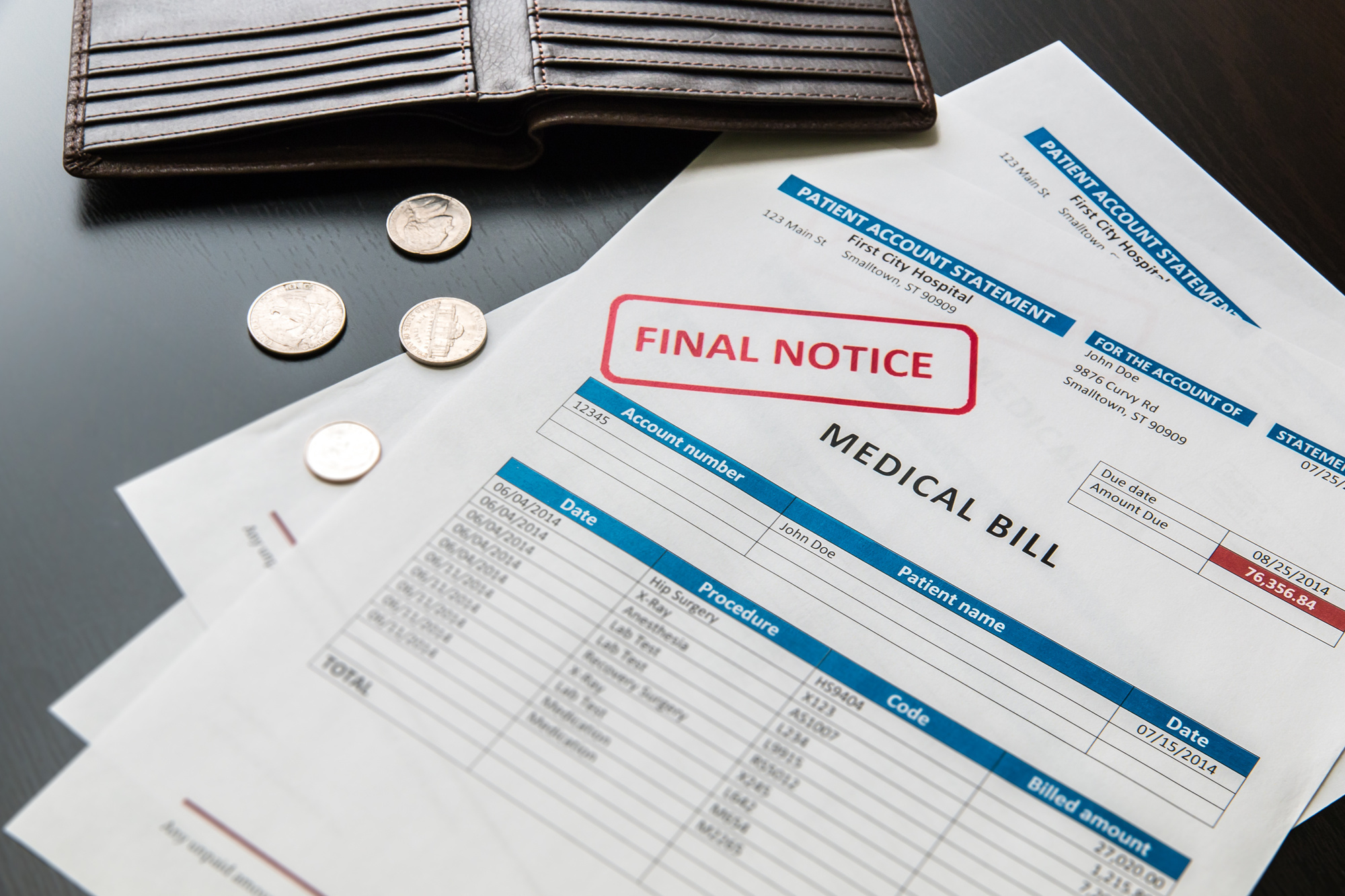

Do you need help paying hospital bills? If so, you are not alone. Poll results from the Kaiser Family Foundation reveal that roughly a quarter of American families have had problems meeting medical bills. This is not surprising, seeing as health care in the US is more expensive than in any other country in the world. If you are facing unforeseen …